Have you ever glanced at your train ticket and asked yourself, “Why doesn’t this include VAT?” or “Am I paying tax when I travel by train?” These are valid questions that UK travellers and business professionals frequently ponder.

With VAT (Value Added Tax) being applied to so many products and services in the UK, it’s understandable to expect the same for train travel.

However, the VAT treatment of public transport, particularly trains, is an area where common perception doesn’t always align with reality.

Train tickets in the UK do not show a VAT amount because they fall under a unique category known as “zero-rated”. This doesn’t mean VAT isn’t involved, but rather that it is applied at a rate of 0%.

This blog aims to break down exactly what that means, explain the difference between zero-rated and exempt services, explore how VAT applies to other transport modes, and guide you on what to do when you’re managing travel expenses as an individual or a business.

What Is VAT and How Does It Apply to Public Transport in the UK?

Value Added Tax, or VAT, is a consumption tax levied on most goods and services sold in the UK. The standard VAT rate is 20%, with some goods qualifying for reduced rates of 5% or even zero. While many day-to-day purchases include this tax, public transport, such as trains, is treated differently under UK tax law.

Public transport that meets specific conditions is eligible for zero-rating, which means VAT is applied at 0%:

- The transport must be domestic (within the UK)

- The vehicle must be designed to carry at least 10 passengers

- The service must be available to the general public or a specific group, like school children

Zero-rated is not the same as VAT-exempt. Services classified as zero-rated are still within the VAT system, allowing providers to reclaim input VAT on related business expenses.

This distinction benefits both service providers and passengers, as operators can manage costs without passing VAT onto the consumer.

This framework encourages the use of mass transit by keeping prices affordable and reducing administrative burdens for operators.

Are Train Tickets Zero-Rated or Taxed Under UK VAT Rules?

Train tickets in the UK are zero-rated under HMRC’s VAT Notice 744A. This means while they are subject to VAT, the rate charged is 0%.

Zero-rating is different from exemption because it allows rail companies to reclaim input VAT on operational costs, which helps to maintain or improve service levels without transferring the tax burden to passengers.

This zero-rating applies to:

- Domestic train journeys within the UK, whether short or long-distance

- All classes of travel, including standard and first-class fares

- Rail excursions and mystery trips, provided they are not bundled with admission to entertainment or events

However, if the transport is part of a package that includes entry to a theme park, concert, or cultural site and is supplied by the same or connected provider, it is no longer considered zero-rated. In those cases, the standard VAT rate of 20% may apply to the full package price.

This distinction is crucial for tour operators and event organisers, as it affects how ticket pricing and tax liabilities are calculated.

Can You Claim VAT on Train Tickets for Business Travel?

Many businesses regularly incur costs related to employee travel, including train journeys for meetings, site visits, or commuting between offices. However, even though train fares are a valid business expense, they do not typically qualify for VAT reclaims.

This is because:

- VAT on domestic UK train fares is charged at 0%

- There is no actual VAT included in the ticket price to reclaim

- Receipts for these tickets will reflect a zero-rated status

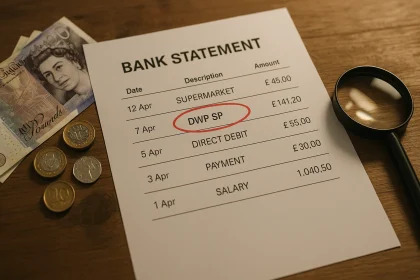

So, even if you receive a receipt from the Trainline or another provider, the VAT amount shown will be £0. That doesn’t mean the receipt is useless.

It still serves an important purpose in your business expense tracking and can be used in your accounting records to justify zero-rated travel expenses.

Some business travellers may mistakenly attempt to claim VAT on these fares. HMRC could reject such claims during audits, so it’s essential for businesses to understand that only services with VAT charged (usually at the standard or reduced rate) are reclaimable. In the case of UK train travel, that opportunity simply doesn’t exist.

Where Can You Get a VAT Receipt for Train Travel?

Despite the zero-rated status, VAT receipts for train travel are often still required, especially for expense reports and internal accounting procedures in businesses.

While these receipts won’t help with VAT reclaim, they do support transparency and compliance in business operations.

VAT receipts or expense summaries can be obtained from several sources:

- Trainline: Offers downloadable receipts for most bookings. These include travel details and VAT indication (usually zero).

- Rail operators: Companies like Avanti West Coast, Great Western Railway, and LNER often allow customers to download or request travel receipts online or via customer service.

- Corporate travel platforms: If train travel is booked through a business portal like TravelPerk or Egencia, expense receipts are usually consolidated automatically.

Although these receipts show zero VAT, they still contain essential information:

- Travel date and time

- Passenger name or booking reference

- Payment amount

- Tax information (stating 0% VAT)

This documentation is sufficient for business recordkeeping and can be included in financial audits to explain the nature of the expense.

How Does VAT Differ for Other Types of Public Transport?

While trains are zero-rated, the VAT landscape for other forms of public transport in the UK is more varied and situation-specific. The VAT treatment depends on the type of transport, its purpose, and even the size of the vehicle in some cases.

Domestic Buses and Coaches

Standard bus and coach services with seating for ten or more passengers are zero-rated. This includes intercity coaches like National Express and Megabus. However, if the bus fare is bundled with an event or theme park entry, the standard 20% VAT may apply.

Taxis and Uber

Taxi fares are subject to standard-rate VAT if the provider is VAT-registered. Many traditional taxi companies fall into this category. On the other hand, most Uber drivers are self-employed and not VAT-registered, so VAT is typically not included or reclaimable in Uber fares.

Ferries and Canal Boats

Ferries capable of transporting more than ten people are zero-rated unless the trip is bundled with entertainment or cultural events. Short boat rides within an amusement park or event venue could attract standard VAT.

Air Travel

Public air travel, including domestic UK flights, is zero-rated for VAT. However, passengers are subject to Air Passenger Duty (APD), which is not the same as VAT. Private flights for entertainment purposes may be standard-rated.

Car Hire and Leasing

Car rentals and leases are subject to standard VAT, usually at 20%. Businesses may reclaim this VAT if the car is used strictly for work purposes and not available for personal use.

International and Cross-border Travel

The VAT treatment for international rail travel depends on the route and the jurisdictions involved. For instance, Eurostar tickets may not follow the same rules as domestic UK train travel and could be partially subject to VAT, depending on where the journey begins and ends.

Understanding these nuances ensures accurate financial reporting and helps individuals and companies avoid costly tax mistakes.

Why Doesn’t VAT Show on Most Train Tickets in the UK?

Train tickets in the UK typically do not display VAT because they are classified as zero-rated services. Since the VAT rate is 0%, there’s no additional charge applied to the base fare, and therefore no breakdown shown on the ticket or receipt.

This is a deliberate simplification within the VAT system designed to keep public transport accessible and straightforward for users. For consumers, this reduces confusion and keeps pricing transparent.

For operators, it eliminates the administrative need to calculate and remit VAT on passenger fares. Although the transport is within the scope of VAT, the zero rating means the tax effect is neutral, and no VAT is passed along to the traveller.

As such, when reviewing your receipt or booking confirmation, the absence of VAT details is entirely expected and compliant with HMRC’s guidelines.

What Do UK Travellers Need to Know About Train Ticket VAT?

Whether you’re a regular commuter or an occasional traveller, understanding VAT on train tickets helps set accurate expectations and avoids confusion. In the UK, train tickets are zero-rated for VAT, meaning passengers don’t pay any tax on the fare. As a result, tickets don’t show VAT, and it’s not possible to claim it back, even for business travel.

Travellers should still keep receipts for accounting or expense reimbursement, especially when travelling for work. However, these receipts will reflect the zero-rated VAT status and indicate that no VAT was included in the purchase.

It’s also important to differentiate between types of public transport, as VAT treatment varies. Knowing how these differences affect what you pay and what you can or cannot reclaim is crucial for personal budgeting and business compliance.

VAT on Public Transport Modes in the UK

Below is a comprehensive comparison of how VAT applies to different modes of transport across the UK.

| Transport Type | VAT Status | VAT Reclaimable | Notes |

| Train (domestic) | Zero-rated | No | Applies to all UK domestic train services |

| Bus | Zero-rated | No | Includes local and long-distance bus routes |

| Coach | Zero-rated | No | Applies to services not bundled with other offers |

| Taxi | Standard | Yes (if VAT-registered) | Request receipt with VAT number |

| Uber | Varies | Rarely | Most drivers not VAT registered |

| Ferry | Zero-rated | No | Must carry 10+ passengers, not entertainment-bound |

| Flight (UK domestic) | Zero-rated | No | Subject to Air Passenger Duty, not VAT |

| Car Hire | Standard | Yes (business use) | Reclaimable with proper documentation |

This breakdown allows both travellers and business owners to better understand the tax implications of their transport choices and record expenses accordingly.

Conclusion

Understanding how VAT applies to train tickets in the UK is more than just a curiosity—it’s an important piece of knowledge for both consumers and businesses.

Train travel, being zero-rated, doesn’t carry a VAT charge, which helps keep it affordable and simplifies the travel process. For business users, it’s crucial to note that despite being within the VAT system, these tickets cannot be used to reclaim tax.

Staying informed helps you avoid common accounting mistakes and ensures compliance with HMRC regulations. Whether you’re planning a holiday or logging expenses for work, knowing how VAT functions in the world of public transport can save time, confusion, and unnecessary effort.

FAQs

Why is there no VAT listed on UK train tickets?

Train fares are zero-rated for VAT, so no VAT is added or shown on the ticket.

Can I reclaim VAT on UK train fares for business purposes?

No, because no VAT is charged, there is nothing to reclaim on UK train tickets.

Do international train tickets include VAT?

VAT on international train fares depends on the countries involved and the route taken.

Are tickets from Trainline VAT-inclusive?

Trainline tickets are zero-rated, so they do not include any VAT in the price.

Is VAT charged on first-class train travel in the UK?

No, both standard and first-class UK train travel are zero-rated for VAT.

What’s the VAT rate on UK public transport?

Most public transport, including trains and buses, is subject to a 0% VAT rate.

Can I request a VAT invoice for train tickets in the UK?

Yes, but the invoice will typically show a VAT rate of 0% due to zero-rating.