Have you ever noticed “DWP SP” listed on your bank statement and wondered what it actually means? You’re not alone. For many in the UK, these abbreviations can cause confusion, especially when you aren’t expecting a payment.

Bank statements often include codes and acronyms that aren’t immediately clear, and DWP SP is one that regularly appears for pensioners or those approaching retirement age.

In this article, you’ll learn exactly what “DWP SP” stands for, why it appears on your statement, who receives it, and what steps to take if you’re unsure about the payment.

We’ll also explore similar codes you might see from the Department for Work and Pensions, potential errors, and how to keep track of your pension entitlements online.

Whether you’re managing your own pension or helping a relative, understanding this term will help you stay in control of your finances. Let’s decode “DWP SP” and make your bank statement easier to understand.

What Is DWP SP and Why Does It Show on Your Bank Statement?

When you see “DWP SP” on your bank statement, it refers to a payment made by the Department for Work and Pensions (DWP) and specifically denotes the State Pension (SP).

This is a regular government payment to individuals who have reached the qualifying pension age and are eligible based on their National Insurance contributions.

The Department for Work and Pensions is the UK government body that manages welfare, pensions, and other forms of financial support. It issues State Pension payments directly into the bank accounts of eligible claimants.

These payments are scheduled at regular intervals, and the label “DWP SP” serves as a transaction reference to indicate the payment’s source and purpose.

If you qualify for the State Pension and have completed your claim either online or through the Pension Service, this label will appear every four weeks in your statement. The amount you receive depends on your contribution history and pension type. Seeing this code is a normal part of retirement income for millions across the UK.

Who Typically Receives DWP SP Payments?

DWP SP payments are intended for individuals who have reached the State Pension age, which is currently 66 years for most UK residents.

To qualify, recipients must have made or been credited with at least 10 years of National Insurance contributions during their working life. For a full pension, this increases to 35 qualifying years.

Those who see DWP SP in their bank accounts typically meet the following criteria:

- Have reached the eligible State Pension age

- Have applied for the State Pension via GOV.UK or through the Pension Service

- Have a sufficient National Insurance contribution record

- Have nominated a UK bank account to receive the payment

Once your pension application is approved, you’ll receive the payments regularly. The amount may vary based on whether you’re receiving the basic State Pension or the new State Pension. These payments continue for life and are updated annually in line with inflation.

For example, under the new State Pension scheme, someone with full contributions may currently receive around £221.20 per week, which gets deposited as a DWP SP transaction.

How Often Are DWP SP Payments Made?

State Pension payments from the DWP appear on your bank statement typically every four weeks, which is the standard payment schedule for most claimants in the UK. While many people assume this is a monthly payment, it’s actually issued every 28 days, which may not align with calendar months.

Here’s what you need to know about the payment frequency:

- Most pensioners receive their payments every four weeks

- Some individuals may be eligible for weekly payments, depending on specific entitlement or requests

- The day your payment arrives usually depends on your National Insurance number

- Payments are made directly into your nominated bank account

You can check your payment schedule through your Government Gateway account or contact the Pension Service if you’re unsure about the expected date. Knowing this timing helps with budgeting and identifying unexpected transactions that may need to be verified.

Regular payments labelled “DWP SP” mean your pension is on track. If anything seems off, it’s worth investigating further to avoid missing or misdirected funds.

Why Might You See DWP SP If You Didn’t Apply for a Pension?

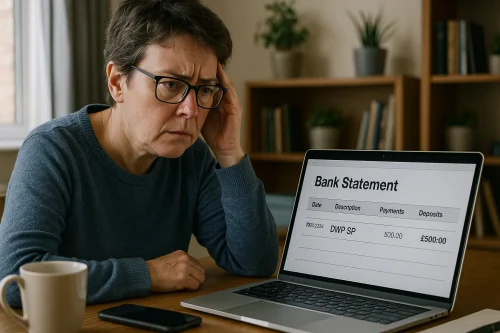

It’s understandable to feel puzzled if a DWP SP payment appears in your bank account unexpectedly, especially if you haven’t applied for a State Pension. While this might raise concern, there are several legitimate reasons why this could happen.

Some common causes include:

- A joint bank account with a spouse or family member who receives the State Pension

- A delayed or backdated pension claim resulting in a lump sum payment

- A final pension payment made after a loved one has passed away

- An administrative error, where the payment was directed to the wrong account

In some cases, individuals may have forgotten that they completed a pension claim, especially if it was done months earlier and processed later. While such unexpected transactions are usually genuine, it’s important to take them seriously.

Start by checking any recent correspondence from the DWP. Speak with family members if the account is shared. If it still doesn’t make sense, contact the DWP or Pension Service to confirm whether the payment was meant for you.

What Are Other DWP Codes You Might See on a Bank Statement?

Beyond “DWP SP,” you may notice other codes from the DWP that refer to different types of benefit or support payments. These references can seem cryptic, but each serves a specific purpose in identifying the source of funds.

Here’s a helpful table of common DWP bank statement codes and their meanings:

| Code on Bank Statement | Meaning | Benefit Type |

| DWP SP | State Pension | Retirement income for eligible individuals |

| DWP AA | Attendance Allowance | Support for older people needing care |

| DWP PIP | Personal Independence Payment | Disability benefit for working-age adults |

| DWP UC | Universal Credit | Income support for low-income households |

| DWP ESA | Employment and Support Allowance | For those unable to work due to illness |

| DWP JSA | Jobseeker’s Allowance | Assistance for job seekers |

| DWP CA | Carer’s Allowance | Support for unpaid carers |

| DWP XB | Christmas Bonus | £10 bonus for pensioners and benefit claimants |

| DWP RFD | Refund or adjustment | Correction for underpayments |

Recognising these codes helps clarify your finances, especially if you receive more than one form of government assistance. If you’re unsure about any of them, the GOV.UK website provides official explanations for each.

What Should You Do If You Don’t Recognise the DWP SP Payment?

If a DWP SP payment shows up and you don’t recall applying or becoming eligible, it’s essential to investigate before using the funds. Although it’s often a legitimate transaction, taking the right steps ensures you don’t accidentally misuse government money.

Here’s what you should do:

- Check your age and pension status to see if you’ve recently qualified

- Look through DWP letters or emails for payment notifications

- Speak with family members, especially if you share accounts

- Contact the DWP or Pension Service directly using the details on GOV.UK

- Avoid spending the money until you’re sure it’s intended for you

Verifying the source early prevents complications and helps avoid legal or financial issues later. If the payment is an error, the DWP will explain how to return it. Keeping track of your State Pension status can help you catch and clarify unexpected payments.

Could a DWP SP Payment Be an Error or Fraudulent?

While rare, DWP SP payments can sometimes result from errors or fraudulent activity. These errors typically happen due to mistyped account details, outdated information, or system issues. There have also been instances of scams where fraudsters mimic DWP references to access personal banking details.

If you suspect the payment was made in error or think it could be part of a scam, remain cautious. Do not transfer or withdraw the funds until you’ve confirmed the payment’s legitimacy with the DWP.

The safest approach is to:

- Use official GOV.UK contact points to reach the DWP

- Report suspicious payments to your bank’s fraud department

- Keep records of all communication for reference

The DWP has procedures in place to recover overpayments and will investigate thoroughly if a fraud case is suspected. Quick action on your part ensures protection against any future issues.

Why Understanding DWP SP and Other Bank Codes Matters

Understanding codes like DWP SP isn’t just about decoding your bank statement, it’s about staying informed and financially secure. Knowing what each transaction means helps you manage your income, monitor government benefits, and detect potential problems early.

Many people receive multiple payments from the DWP, especially in retirement. Recognising the difference between a pension and a benefit payment ensures accurate budgeting and tax reporting. It’s also important for carers who manage someone else’s finances.

Mistaking one code for another could lead to overspending or misreporting income. Staying informed helps you avoid these issues and supports better financial planning, whether for yourself or your loved ones.

Take a moment to learn the meanings of these common abbreviations so you can maintain control of your finances with confidence and clarity.

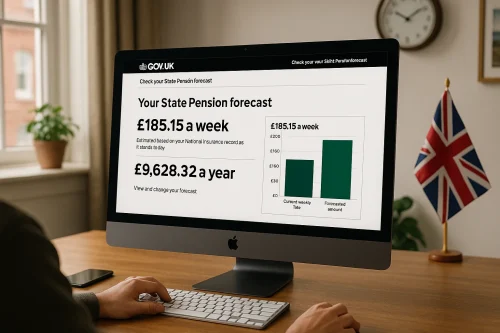

How to Check and Track Your State Pension Online?

Keeping track of your State Pension and related payments is easy with the right online tools. The UK government provides secure platforms to check your pension forecast, payment history, and entitlement.

Here’s how you can manage your pension details:

- Visit the GOV.UK website and log in to your personal tax account via Government Gateway

- Use the State Pension forecast tool to see how much you’re entitled to

- Update your bank details or contact information if anything changes

- Contact the Pension Service with your National Insurance number to clarify payment issues

- Review your National Insurance record to understand your contribution history

By checking regularly, you can stay up to date with your payments and avoid surprises. These tools are especially helpful if you’ve deferred your pension, changed your circumstances, or want to understand how future entitlements might change. Always use the official GOV.UK platform to ensure security and accuracy.

Conclusion

Seeing “DWP SP” on your bank statement is usually nothing to worry about. It simply means you’ve received a State Pension payment from the Department for Work and Pensions. However, understanding why it’s there, who it’s for, and what it means helps you stay in control of your finances.

Whether you’re expecting the payment or it appears unexpectedly, there are simple steps you can take to confirm its origin. Knowing how and when pensions are paid, identifying other DWP codes, and using online tools to manage your pension are essential for peace of mind.

By taking the time to understand your statement, you empower yourself to make better financial decisions and protect your income in the long term.

FAQs

Is DWP SP paid weekly or monthly?

DWP SP payments are usually made every four weeks. In some cases, people may receive them weekly if requested and approved.

Can I receive both State Pension and Universal Credit?

Yes, you can receive both, but your State Pension may affect how much Universal Credit you receive.

What happens if I receive a DWP SP payment in error?

You should contact the DWP immediately and avoid spending the money until it is verified.

How can I check if I’m entitled to State Pension?

You can use the State Pension forecast tool on GOV.UK to check your eligibility and payment estimate.

Is the State Pension taxable income?

Yes, the State Pension counts as taxable income, although tax is not deducted at source.

What does DWP AA or DWP RFD mean on my statement?

DWP AA is Attendance Allowance for care needs, and DWP RFD indicates a refund or correction.

Can I update the bank account my DWP SP is paid into?

Yes, you can update your payment details by contacting the Pension Service or via your Government Gateway account.