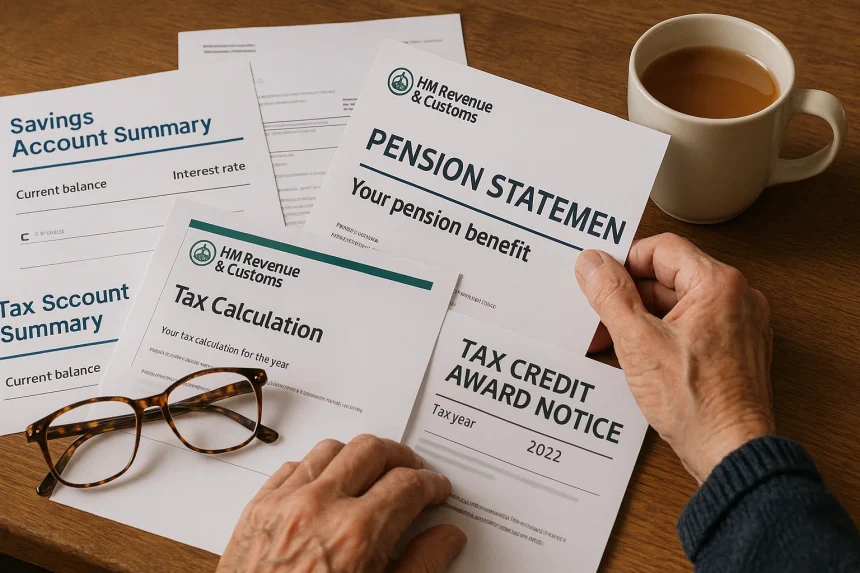

Have you recently received a letter from HMRC and felt unsure about what it means for your retirement income or savings? Many UK pensioners are surprised when they get an unexpected tax notice in the post, especially if they believed their income was already sorted.

But these notices are often triggered by small changes in your financial details, such as interest earned from savings or updates in pension income.

Understanding why these notices arrive and how to respond can help you stay in control of your retirement finances. Whether it’s a tax code adjustment or a P800 letter telling you that you’ve underpaid or overpaid, these documents are more common than you think.

With the right knowledge, you can avoid unnecessary tax surprises, handle HMRC communications with confidence, and protect your pension savings.

What Are HMRC Notices and Why Do UK Pensioners Receive Them?

HMRC notices are official communications sent to inform you about changes in your tax status, payments, or adjustments. As a pensioner, you may think your tax affairs are straightforward, but in reality, there are several reasons HMRC might need to contact you. Notices are typically sent because HMRC has received updated financial data about your savings interest, pension income, or any changes to your overall taxable income.

These letters come in various forms, including P800 tax calculations, PAYE coding notices, or statements about pension savings exceeding the annual allowance. A common reason for receiving one is when your savings interest exceeds the Personal Savings Allowance, which is currently £1,000 for basic-rate taxpayers and £500 for higher-rate taxpayers.

If your total income changes or if you have multiple pension sources, HMRC may need to recalculate how much tax you owe. Although these notices may initially feel alarming, they are part of HMRC’s process to ensure that the correct amount of tax is being paid each year. Understanding their purpose can reduce confusion and help you manage your finances better.

What Triggers HMRC Notices for Pensioners’ Savings and Income?

There are several financial situations that could trigger a notice from HMRC, especially for pensioners who rely on multiple sources of income in retirement.

Here are the most common reasons:

- Exceeding the Personal Savings Allowance (PSA): If your savings interest exceeds the tax-free PSA (£1,000 for basic-rate and £500 for higher-rate taxpayers), you may be taxed.

- Underpayment or Overpayment of Tax: If you’ve paid too little or too much tax throughout the year, HMRC may send a P800 tax calculation letter to correct this.

- Annual Allowance Breaches: If your total pension contributions exceed the annual allowance of £60,000, you might be sent a pension savings statement requiring a Self Assessment.

- Changes in Tax Code: HMRC may adjust your tax code to collect tax owed through your pension provider.

- Winter Fuel Payment Recovery: If your total income exceeds £35,000 and you receive the Winter Fuel Payment automatically, HMRC might recover it via your tax code or Self Assessment.

Even minor income changes can prompt these letters, especially if you receive income from more than one pension or have interest-earning savings accounts.

How Does HMRC Know About Your Pension and Savings?

HMRC gathers your financial data from various sources each year to determine if your tax status remains accurate. This is a routine process that happens annually and includes data-sharing agreements with financial institutions and government bodies.

- Banks and Building Societies: They automatically report the interest you earn from savings accounts.

- Pension Providers: Your workplace or private pension providers inform HMRC of your retirement income.

- Department for Work and Pensions (DWP): This government body shares information about your State Pension and other related benefits.

- Tax Year Reconciliation: At the end of each tax year, HMRC compares the income reported with the tax you’ve paid to see if any adjustments are needed.

Even if you’re retired, income from savings or pensions is still taxable, so HMRC uses this information to issue notices if it detects a mismatch or taxable event.

What Do HMRC P800 and Tax Code Notices Mean?

A P800 notice is one of the most common documents pensioners receive. It is sent when HMRC determines you’ve overpaid or underpaid tax during the previous tax year.

Overpayments might occur if your income was lower than HMRC expected or if a tax code was too high. Underpayments usually result from income increases that weren’t reflected in your tax code.

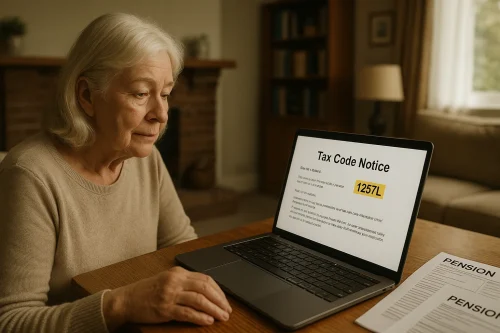

A tax code notice or PAYE coding notice explains how your income will be taxed in the coming year. If you have multiple pensions or savings income, HMRC may adjust one pension provider’s tax code to collect the right amount across your payments.

These notices are important for keeping your tax up to date. By understanding what they mean, you can ensure your tax payments are correct and avoid future discrepancies.

How Are Tax Code Changes Applied to Your Pension?

Tax code changes are one of the key ways HMRC collects the right amount of tax from pensioners. If your savings or other income causes you to owe tax, your code is adjusted so the correct tax is deducted from your pension automatically.

- Automatic Adjustments: HMRC can change your tax code based on new financial information without needing your approval.

- Applied via Pension Providers: The adjusted code is sent to your pension provider, which then deducts the tax from your payments.

- Reflects Total Income: The new code takes into account all sources of income, including workplace pensions, private pensions, and interest from savings.

- PAYE System: These changes happen through the Pay As You Earn (PAYE) system, just like in employment.

This ensures that you pay any owed tax in manageable amounts over time, rather than facing a large bill at once.

What Should You Do If You Receive a Notice from HMRC?

Receiving a tax notice might feel worrying, but knowing how to respond can help ease the pressure and avoid penalties.

Follow these steps when a notice arrives:

- Do Not Ignore the Letter: Acting quickly prevents interest or fines on unpaid tax.

- Read the Details Carefully: The notice usually explains why there’s been a tax change or underpayment.

- Compare with Your Records: Check pension payslips, savings interest summaries, and prior tax documents.

- Contact HMRC if Unsure: Use their official contact numbers or Personal Tax Account online if anything is unclear or seems incorrect.

- Ask About Payment Plans: If you owe tax but can’t pay in one go, HMRC can help you set up a monthly payment plan.

- Watch for Errors: Mistakes can happen, especially if your income changed recently or if you’ve started a new pension.

Taking these steps promptly helps you stay compliant, reduce stress, and correct any issues before they escalate.

When Do Pensioners Need to File a Self Assessment Tax Return?

While many UK pensioners are taxed through the PAYE system, there are situations where filing a Self Assessment tax return becomes necessary. If your savings income is £10,000 or more, you must register and complete a return with HMRC.

You’ll also need to file a return if you’ve breached the annual pension savings allowance and received a pension savings statement. This report must be declared, and any additional tax paid through the Self Assessment process.

Additionally, pensioners with complex income sources or foreign income may be required to submit returns. Filing late or ignoring HMRC’s notice can result in penalties, so it’s vital to act if you’re notified. Always refer to GOV.UK for official deadlines and guidance.

How Can You Avoid Receiving Unexpected HMRC Notices?

While you can’t eliminate all tax notices, you can reduce their frequency with a proactive approach. Understanding how HMRC tracks your income and taking small steps throughout the year can prevent unnecessary surprises.

Regularly Checking Your Tax Code

Your tax code determines how much tax is deducted from your pension. If it’s incorrect, you could overpay or underpay. You can review your current code on your pension payslip or by logging into your HMRC Personal Tax Account. Keeping this information updated with any new income sources helps avoid tax issues.

Reviewing Savings Interest Annually

Interest from savings is reported automatically, but with rising interest rates, even small savings can generate taxable income above the PSA. Review your annual interest statements from banks and building societies to monitor if you’re nearing the limit. Combine interest from all accounts, including ISAs and joint accounts, for a full picture.

Updating Hmrc When Income Changes

If you’ve started drawing from a new pension, received a lump sum, or closed an account, let HMRC know. Any change in income can affect your tax code or PSA eligibility. Prompt updates mean your tax stays accurate without triggering correction notices.

Common Triggers vs Prevention Tips

| Trigger | How to Prevent It |

| Exceeding PSA | Monitor savings interest across all accounts |

| Tax code errors | Check and update your code annually |

| Multiple pension sources | Inform HMRC about all income streams |

| Overlooked foreign savings interest | Declare all income, even from abroad |

| Income increase due to drawdown | Spread pension withdrawals over two tax years |

By reviewing your finances annually and keeping HMRC informed, you’ll be far less likely to receive an unexpected letter.

How Can You Make Your Pension and Savings More Tax-Efficient?

You can reduce the chances of tax issues by managing your pension and savings in a way that’s efficient and within your tax allowances.

Consider the following strategies:

- Spread Income Over Tax Years: Avoid large withdrawals in a single year.

- Use Tax-Free Accounts Like ISAs: Interest earned in ISAs is not taxable.

- Take Advantage of PSA and Personal Allowance: Know your limits and monitor income accordingly.

- Check When Promotional Rates Expire: A sudden interest rate increase could tip you over your allowance.

Key Allowances for Pensioners:

| Allowance | Amount | Applies To |

| Personal Allowance | £12,570 | Most pension income |

| Personal Savings Allowance | £1,000 / £500 | Taxable interest on savings |

| Starting Rate for Savings | Up to £5,000 | Additional relief for low-income |

| Pension Lump Sum Allowance | 25% tax free | Withdrawals from private pensions |

Efficient planning ensures you’re not caught off guard by HMRC letters.

Is Your HMRC Notice Genuine or a Scam?

Unfortunately, pensioners are often targeted by scammers pretending to be HMRC. To protect yourself, it’s vital to recognise the signs of a genuine notice. HMRC generally communicates via post, and their letters will include your National Insurance number, tax code, or P800 reference.

They will never request your bank details via SMS or email. If you receive an unusual message, don’t click any links. Instead, contact HMRC directly using contact details from the official GOV.UK website. Genuine tax notices are designed to inform, not to pressure or scare.

By staying alert and verifying any unexpected contact, you can avoid becoming a victim of tax scams and keep your finances safe.

How Do You Claim a Tax Refund or Handle Underpayment?

Whether you’ve received a refund or a bill, knowing what to do next is key to staying on top of your finances.

Step-by-step for Claiming a Refund (Online, Cheque, Adjustment)

If your P800 shows an overpayment, you can claim it via your Personal Tax Account online. If you’re unable to do it digitally, HMRC will post you a cheque. In some cases, the refund will be adjusted through your next year’s tax code.

Refund Methods and Timelines

| Method | How It’s Paid | Timeframe |

| Online claim via HMRC site | Direct to your bank | Within 5 working days |

| Automatically issued cheque | Sent to your home address | Within 2–4 weeks |

| Payroll adjustment | Spread over tax year | Applied monthly |

What Happens if You Owe Tax and Don’t Act?

If you underpaid, HMRC may adjust your tax code to recover the amount gradually. However, ignoring the notice can result in penalties or interest being added to the original sum. Always respond promptly and arrange a payment plan if needed to avoid escalating costs.

Conclusion

Understanding HMRC notices for UK pensioners savings is essential for keeping your retirement income on track. These notices are not meant to alarm but to inform you of changes that help keep your tax accurate.

From exceeding savings allowances to updates in pension income, HMRC works behind the scenes using your financial data.

With proactive steps like checking your tax code, monitoring interest, and understanding your tax-free allowances, you can avoid most issues. When notices do arrive, knowing what they mean and how to respond puts you back in control. Retirement should be a time of financial ease, not uncertainty, and with the right knowledge, it can be.

FAQs

Are pensioners going to be taxed on their State Pension?

Yes, State Pension is taxable if your total income exceeds your Personal Allowance. HMRC collects tax by adjusting your tax code.

How do HMRC know if you have savings?

Banks and building societies automatically report your annual interest earnings to HMRC. This is used to calculate your total taxable income.

What do pensioners need to do after receiving an HMRC notice?

Carefully check the notice for errors and compare it with your records. Contact HMRC if anything seems incorrect or unclear.

Do I have to inform HMRC of my savings interest?

Usually not, as banks report it directly. However, if you have foreign or unreported accounts, you must notify HMRC.

What is the HMRC warning for anyone with over £3,500 savings in their bank account?

If your savings interest exceeds your PSA, HMRC may adjust your tax code to collect tax. Monitoring interest regularly helps avoid this.

Is a P800 tax calculation the same as a tax bill?

No, it is a summary showing whether you’ve overpaid or underpaid tax. It may lead to a refund or adjustment, not an immediate demand.

How can I prevent tax underpayment as a pensioner?

Keep your tax code up to date and inform HMRC about all income sources. Review your finances annually to stay ahead.