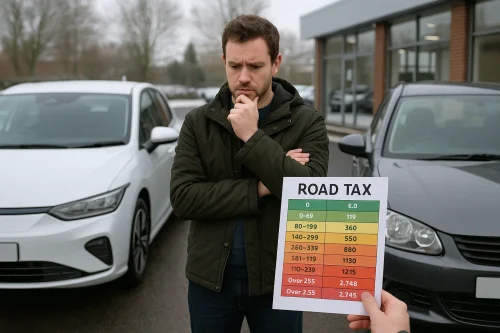

Are you ready for the biggest driving law updates to hit the UK in years? As December unfolds, British motorists face a sweeping set of changes introduced in the latest Autumn Budget.

From new car tax schemes and mileage-based charges to congestion zone updates and company car rules, these changes are set to affect millions across the country.

Whether you drive an electric vehicle, a plug-in hybrid, or a traditional petrol or diesel car, understanding how these updates apply to you is essential. Chancellor Rachel Reeves’ announcements reflect a shift in how the UK Government plans to tax, incentivise, and regulate drivers going forward.

Some changes are immediate, while others take effect over the coming years, but they all carry long-term financial and practical implications. In this guide, you’ll learn everything you need to know about the December car tax changes and how to prepare for them effectively.

What Are the Key Car Tax Changes Introduced in December?

The December driving law overhaul is among the most impactful policy shifts in recent memory. Spearheaded by Chancellor Rachel Reeves during the Autumn Budget, the latest measures set the stage for long-term revenue generation and greater alignment between traditional fuel and electric vehicle taxation.

Though the most significant updates, like the mileage-based tax, won’t come into force until 2028, December 2025 already brings key developments that drivers must be aware of.

Electric vehicle drivers are particularly affected, with changes coming to London’s Congestion Charge and company car reimbursement rates. Petrol and diesel drivers will also notice a freeze in fuel duty continuing until at least September 2026.

Funding initiatives for EV infrastructure have been enhanced, including grants and charger installations, but these incentives come alongside higher usage-based taxation on electric vehicles.

The Government is balancing the playing field between traditional and electric vehicle ownership. These reforms are designed to recoup lost tax revenue from declining fuel duty collections while supporting a green transition through adjusted incentives and expanded infrastructure.

How Will the New Mileage-Based Tax (eVED) Work?

Among the most talked-about updates in the December car tax changes is the introduction of the Electric Vehicle Excise Duty (eVED), a mileage-based tax specifically targeting electric vehicles and plug-in hybrids. Although it’s set to roll out in April 2028, the groundwork and public awareness start now, making it a key issue for drivers to understand early.

What is eVED and who will it affect?

The new mileage-based tax system, dubbed eVED, is designed to replace the loss of revenue traditionally generated by fuel duty. Since electric vehicles don’t consume fuel in the conventional sense, they escape a significant tax burden, something the Government aims to correct.

eVED will apply to battery electric vehicles (BEVs) and plug-in hybrids (PHEVs). Owners of these vehicles will be taxed based on the number of miles they drive each year.

How Much Will EV and Plug-in Hybrid Owners Pay?

- Battery electric vehicles will be taxed at 3p per mile.

- Plug-in hybrids will face a lower rate of 1.5p per mile.

- These charges are forecasted to generate £1.1 billion in the first year alone.

- For context, an EV driver covering 8,500 miles annually will pay £255, roughly half of what a petrol or diesel driver pays in fuel duty.

Exemptions for Vans, Motorcycles, and Trucks

Not all electric vehicles are treated equally under the eVED system:

- Electric vans, motorcycles, and trucks will initially be exempt.

- This exemption reflects commercial and logistical importance, aiming to avoid stifling business operations during the early adoption phase.

Revenue Expectations and Government Justification

According to the Office for Budget Responsibility (OBR), this measure is critical to maintaining the UK’s tax income amidst rising EV ownership. By 2030, the tax is projected to yield £1.9 billion annually. The move is not just about money, it’s also intended to rebalance incentives and ensure fairness between EV and fuel-based drivers.

However, critics warn that the added cost may deter some from switching to electric vehicles. In response, the Government promises to maintain supportive EV initiatives to soften the impact.

This marks a significant transition in the UK’s transport taxation model, paving the way for a sustainable yet fair system for all motorists.

Will You Have to Report Your Mileage?

Yes, under the new eVED scheme launching in 2028, you’ll be responsible for reporting your vehicle’s mileage. The system is designed to ensure that the right amount of tax is collected based on actual usage, and the Government is introducing a structured approach for this process.

Here’s how it will work:

- You will estimate the distance you expect to travel in a year.

- You can choose to pay the estimated tax upfront or opt for monthly payments via Direct Debit.

- An annual mileage check will be mandatory to verify your usage.

- This check will be integrated into your MOT or done via a new annual mileage verification system, expected to operate through MOT stations.

Accuracy will be key. Under-reporting mileage could lead to penalties or backdated charges, while over-reporting could mean you’re paying more than necessary. This system places more responsibility in the hands of vehicle owners and marks a notable shift in how road tax is administered.

What Is Changing with the London Congestion Charge?

London’s Congestion Charge rules are undergoing a dramatic shift this December. For electric vehicle drivers, the era of tax-free entry into central London is coming to an end. These updates are part of a broader plan by Transport for London to modernise the scheme and make it more equitable for all road users.

Key changes you need to know:

- The Cleaner Vehicle Discount (CVD) will be scrapped on 25 December 2025.

- All electric vehicle owners will be required to pay the £18 daily charge to enter the Congestion Charging Zone, unless they qualify for another exemption.

- From 2 January 2026, a new tiered discount system will be introduced.

- Electric cars will receive a 25% discount on the daily charge.

- Electric vans, HGVs, and quadricycles will receive a 50% discount.

- These discounts will only apply to vehicles registered under the Auto Pay system.

This change reflects the Government’s broader move to normalise taxation across vehicle types and ensure that all drivers contribute toward managing congestion and environmental impacts.

If you’re an EV driver in London, it’s essential to factor this into your costs and plan ahead for the new structure starting in 2026.

Are There Any Positives for EV Drivers?

While the new taxes might feel like a setback, the Government is also introducing several benefits and incentives for electric vehicle owners to help offset the impact.

Here’s what’s in place to support you:

- A £200 million fund has been allocated to significantly expand the UK’s EV charger network, especially in underserved areas.

- An additional £1.3 billion will go towards extending the Electric Car Grant, helping more buyers afford cleaner vehicles.

- The Expensive Car Supplement threshold has been raised, reducing road tax liabilities on mid-to-high-end EVs.

These measures are intended to strike a balance between revenue generation and encouraging continued EV adoption. For many drivers, these grants and infrastructure improvements could mean long-term savings, despite the incoming mileage charges.

If you’re planning to switch to electric, these updates may still offer a financially sensible path forward.

How Will These Tax Changes Affect EV Adoption?

The introduction of new taxes and the gradual removal of exclusive EV benefits are expected to have significant consequences on consumer behaviour, according to industry analysts and the Government’s own projections.

OBR’s Projections of Reduced EV Sales

The Office for Budget Responsibility estimates that the eVED tax and Congestion Charge changes could result in 440,000 fewer EVs being sold over the next five years. This is a major concern for those tracking the UK’s net-zero progress and green transport transition.

Public Perception vs Government Messaging

There’s growing uncertainty among prospective EV buyers. Many fear that the promised cost savings of owning an electric vehicle are being diminished by new charges.

Meanwhile, the Government maintains that these changes are a necessary evolution to ensure fairness and continued funding of road infrastructure.

- Drivers question whether the environmental benefits still outweigh the costs.

- Some believe these moves punish early adopters of electric technology.

- Trust in long-term EV affordability may decline without clearer support.

Can Incentives Offset the Tax Impact?

To counterbalance the negative outlook:

- The increased EV grant funding and charging infrastructure improvements are expected to recover around 320,000 potential lost EV sales, according to the OBR.

- The raised Expensive Car Supplement threshold could encourage uptake in the higher-end EV segment.

While the changes may dampen enthusiasm short-term, the long-term incentives and green policy direction could help maintain momentum for electric mobility.

What’s New in Fuel Duty and Petrol/Diesel Pricing?

For petrol and diesel vehicle owners, there’s at least one welcome update. The fuel duty freeze, initially introduced during the cost-of-living crisis, has been extended again.

Key points to note:

- The 5p per litre fuel duty cut will continue until at least September 2026.

- This freeze aims to stabilise petrol and diesel prices, providing some relief at the pumps.

- The Chancellor hopes this move will prevent inflationary pressure and ease financial burdens for traditional fuel users.

Although EVs are facing more taxation, petrol and diesel drivers aren’t completely off the hook in the long term. Further updates on duty rates may be introduced in future budgets, especially as the fuel economy evolves.

What’s Changing with HMRC Company Car Tax Rates?

If you drive a company car, the tax rules you follow are also changing this December. HMRC has introduced updated advisory fuel rates, effective from 1 December 2025, and they’re particularly relevant for electric vehicle users.

Here’s what’s changed:

- Electric vehicle reimbursement rates have been reduced from 8p per mile to 7p per mile.

- These rates apply when you are reimbursed for business travel in a company car. You must repay your employer for fuel used during private journeys.

These updates align with the Government’s wider push to balance the tax burden across vehicle types. For fleet managers and company car drivers, it’s important to update internal systems and processes to comply with the new rates.

How Does the FCA’s Car Finance Redress Scheme Work?

Another major development this December comes from the Financial Conduct Authority (FCA). In response to growing concerns over mis-sold motor finance, the FCA is proposing a compensation scheme that could cost an estimated £8.2 billion.

Here’s what drivers need to know:

- The FCA’s consultation on the redress scheme has been extended to 12 December 2025.

- Victims of mis-sold car finance could receive around £700 per agreement.

- Payments could begin within months of the scheme’s final approval.

- The initiative aims to address unfair practices that occurred between 2007 and 2024.

This scheme could bring long-awaited justice to thousands of affected motorists. However, the final details are still under review, and another update from the FCA is expected soon.

Summary Table: What UK Drivers Need to Know?

To make it easier to digest the new updates, here’s a quick reference table summarising all the major car tax changes affecting UK motorists.

| Change Type | Effective Date | Who Is Affected | Key Impact |

| eVED mileage-based tax | April 2028 | EV & hybrid drivers | 3p or 1.5p per mile |

| Congestion charge (EV) | 25 December 2025 | London EV drivers | Must pay £18 unless exempt |

| HMRC fuel rate for EVs | 1 December 2025 | Company car users | Rate drops from 8p to 7p per mile |

| Fuel duty freeze | Extended to Sept 2026 | Petrol & diesel drivers | No increase in fuel tax |

| EV incentives | Ongoing | EV buyers | £200m for chargers, £1.3bn for EV grants |

| Car finance redress scheme | Under consultation | Mis-sold finance victims | Average payout £700 |

This table is a snapshot, but each of these changes holds deeper implications depending on your circumstances. Use it as a guide to identify which updates affect you most directly.

What Should You Do Now to Stay Ahead?

With all these updates coming into effect, staying informed and proactive is more important than ever. Whether you’re an EV driver, a company car user, or considering switching vehicles, there are several actions you can take.

Here’s what you should consider doing:

- Review your vehicle usage and plan for eVED self-reporting.

- Sign up for Auto Pay to qualify for Congestion Charge discounts.

- Update fuel reimbursement systems for company car compliance.

- Explore available EV grants if considering a new vehicle purchase.

- Monitor the FCA redress updates if you’ve had car finance agreements between 2007 and 2024.

Staying ahead of these reforms will save you money and ensure full compliance with the evolving road tax system.

Conclusion

The December car tax changes signal a major transformation in the UK’s motoring landscape. While many of these updates won’t be felt immediately, their long-term impact on both electric and fuel-based drivers is undeniable.

From the new mileage-based tax to changes in fuel duty, congestion charges, and company car rates, every type of driver will need to adapt. While new charges may increase costs for some, generous incentives and grants still exist to support EV adoption and responsible motoring.

Make sure you stay informed, plan ahead, and take full advantage of the available benefits. The road ahead is changing, and the more prepared you are, the smoother the journey will be.

FAQs

What is the eVED tax and when does it begin?

The eVED tax is a mileage-based charge for EVs starting in April 2028. It will cost 3p per mile for EVs and 1.5p per mile for plug-in hybrids.

Will all electric vehicles be taxed per mile in 2028?

No, electric vans, motorcycles, and trucks will be exempt initially. Only battery electric and plug-in hybrid cars will be taxed under eVED.

How do I report my vehicle’s mileage accurately?

You’ll estimate annual mileage and pay upfront or monthly. Your mileage will be verified annually through MOT or a new system.

Are there still any benefits to owning an EV after these changes?

Yes, incentives like EV charger funding and the Electric Car Grant still apply. New discount systems and grants will help reduce overall ownership costs.

How does the December Congestion Charge change affect me?

From 25 December 2025, EV drivers must pay the daily Congestion Charge. A tiered discount scheme will launch on 2 January 2026.

Is there a difference in tax for plug-in hybrids vs full EVs?

Yes, plug-in hybrids will be taxed at 1.5p per mile, while full EVs pay 3p per mile. This reflects their lower environmental benefit.

Will the new HMRC fuel rates apply to personal vehicles?

No, these rates apply only to company cars used for business travel. Private vehicle mileage is not affected by HMRC advisory rates.